Sabah Drabu has always believed that the best moments happen around a table, preferably one stocked with fresh, home-cooked food that shows up right when you need it. After years of juggling take-out menus, meal kits, and last-minute grocery runs, she wondered: Why isn’t hiring a chef as simple as ordering delivery?

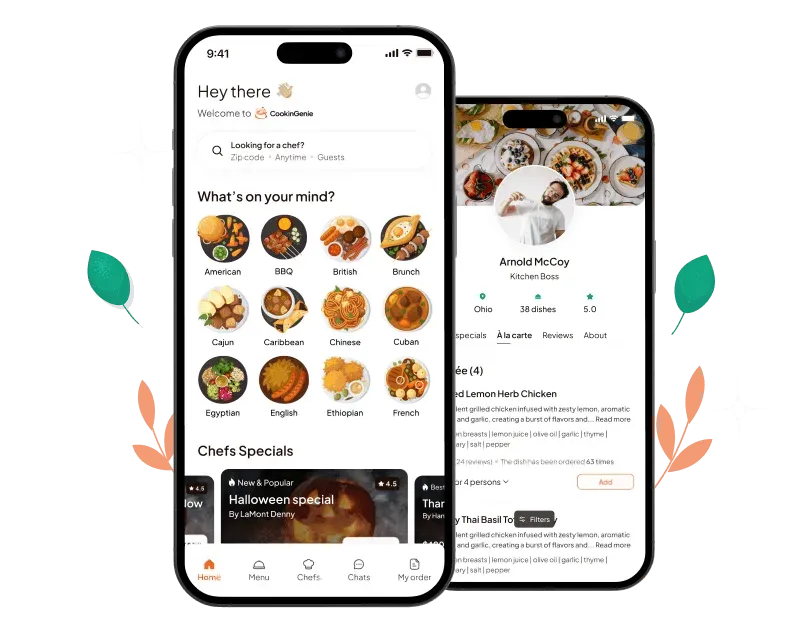

That question became CookinGenie, a marketplace where anyone can book a personal chef for weeknight meal-prep, a milestone birthday, or a blow-out dinner party. Four years later the platform boasts 161 active chefs, coverage across 15 states and counting, and a waitlist of food lovers eager to join.

Yet as demand grew, the team ran head-first into a problem every gig marketplace eventually faces: if payouts lag, nothing else matters.

The Growing Pains of Paying Chefs

Head of Operations George Zappas used to spend Monday mornings hunched over spreadsheets: checking order IDs, calculating grocery advances, keying ACH transfers one chef at a time. A single typo meant a cook might shop for a $1,200 dinner out-of-pocket or wait days for reimbursement.

Things got messy fast:

- One rail, endless friction: Bank transfers suited some chefs, but many preferred Venmo, PayPal, or Cash App and balked at multi-day delays.

- Weekend events, weekday cut-offs: Friday afternoon ACH windows shut down before grocery advances could go out.

- 6 a.m. wake-up calls: “Where’s my money?” calls and texts hit George’s phone before sunrise whenever a payout hung in limbo.

- Tax and compliance scrambles: Each January, the team dropped everything to hunt down contractors who crossed $600 in earnings and mail 1099 tax forms before penalties hit.

“The fastest way to make me angry is to mess with my chefs’ money.” — George Zappas, Head of Operations

Enter Dots: One API, All the Rails

In August 2022 CookinGenie integrated Dots, a unified payouts platform that moves money across any rail (ACH, RTP, PayPal, Venmo, Cash App) while handling KYC, sanctions checks, and year-end tax filing behind the scenes.

Within a week:

- Chefs linked their preferred rail in-app, so ops didn’t have to touch banking details again.

- George’s two-hour spreadsheet ritual turned into payouts going out within 5 clicks and 10 minutes.

- Grocery advances landed the same day, whenever chefs’ banks supported RTP.

- 1099s went out automatically in January, without any need for work from the team.

Results That Taste Like Victory

Before Dots, Monday payout duty swallowed about two hours each week; now it’s less than five minutes, freeing 100+ hours a year for higher value work.

Chefs once limited to a single ACH rail now choose among five payout methods, and those 6 a.m. “Where’s my money?” messages have become rare edge cases.

Onboarding, which used to drag for days while chefs hunted for bank details, now wraps up in minutes because chefs sign up with the rail they already use.

And the dreaded 1099 season, formerly a two- to three-day all-hands sprint, has vanished; Dots generates and files every form automatically.

“Dots frees us to focus on people — coaching chefs on menu creativity instead of chasing payments and bank cutoffs.” — Sabah Drabu, Co-Founder & CEO

Hospitality, Re-Centered on Humans

With manual money-movement gone, the team shipped an AI-powered chef portal that slashes menu-upload time by 90 percent. New markets open faster because payouts simply work.

A Final Bite

CookinGenie exists to make gathering over home-style food effortless. By entrusting payouts to Dots, the team turned a critical back office headache into an invisible delight, freeing them to focus on what really matters: chefs, customers, and the joy of sharing a meal.

If your marketplace juggles hundreds of contractors, ask yourself: could your payout experience pass George’s 6 a.m. phone-call test? If not, it might be time to cook up a change. Book a 15-minute demo here and transform your payouts for good.